ROCE Add-In

ROCE Analytics (Return on Capital Employed Analytics), is a tool created to help you manage the main drivers, to produce the results expected and set objectives as the firm needs. As all managers know, better results are reached if they are measured against some set of criteria. So, the investors and shareholders, have a clear vision about the target objective to get by the funds invested in projects associated to business.

A classical view of ROCE result of divide NOPAT (Net Operating Profit After-Tax) by CE (Capital Employed). Examining this view, we can see that exist a direct relationship with accounts present in both the Income Statement and Balance Sheet Statement, that derive in the most common formula to produce it:

EBIT (1-TaxRate) / CE

Where:

EBIT : Earnings Before Interest and Taxes

Tax Rate: Business Tax Rate (depend from country and kind of business)

CE : Capital Employed in normal business operations

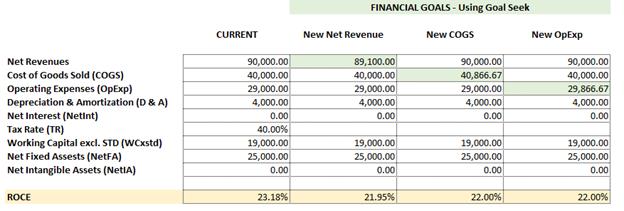

Doing some mathematical developments and transformations, the formula standard can be disaggregated, and handling each component that impact the rate resultant; under those scenarios is possible estimate the values needed to produce the best results, and setting the right objectives to reach it. In a general sense, ROCE depends of:

- Net Revenues

- Cost of Goods Sold

- Depreciation and Amortization

- Net Interest

- Tax rate

- Working Capital (excluding the Short-Term Debt)

- Net Fixed Assets, and

- Net Intangible Assets

ROCE Analytics give us in a simply way, answers to many planning scenarios, reducing the hpurs empoyed to set the right financial objectives. Using this tool allow you get :

- Reduce the efforts to calculate amounts and rates when do the strategic plan

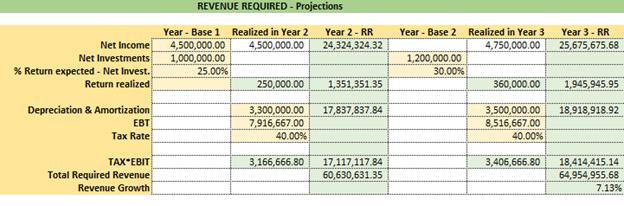

- To know the Revenue Required to cover expected Investments scheduled plans

- How set up financials amounts to get a specific return on investments

- Do sensitivity analysis when evaluate an investment scenario